Buy A New Car

5 Exciting New Cars Coming in 2024 To Watch

The beginning of a new year is always such an exciting time.

It’s a chance for us to think about all the wonderful things that the next 12 months will bring.

For us, that means checking out all the new cars coming to Australia in 2024.

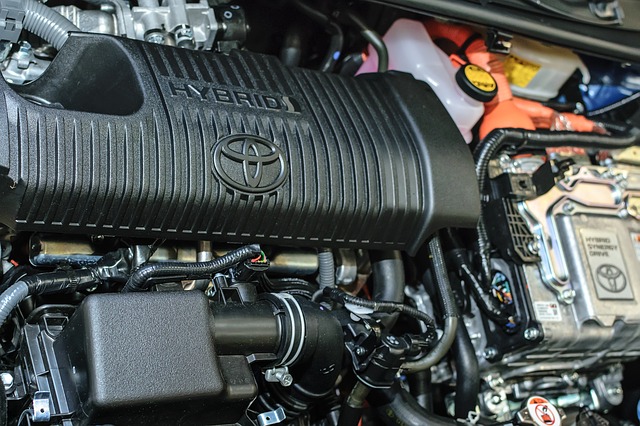

Of course, with the rise of hybrid vehicles, electric vehicles and hydrogen fuel cell vehicles as well, there are now a plethora of options available or coming to the market soon to suit everyone’s tastes.

So, it’s only right that we kick this year off by bringing you a list of 5 exciting new cars coming in 2024 that we think you should be keeping your eye out for.

Who knows – maybe your next car will be one of these!

1. Ford Mustang – 2024 Sports Car to look out for

If you’re a sports car lover, then you’re going to love the new Ford Mustang arriving on Australian shores in early 2024.

We’ve waited a long time for this one to arrive, but it looks like it’s going to be worth the wait.

As part of the release, Ford will also be bringing a limited-edition Mustang to the market known as the Dark Horse. This top-of-the-line model has proven popular in the US, but with only 1000 of these cars being produced, you’ll have to be quick to get your hands on this beauty.

2. Mazda CX-80 – 2024 SUV to look out for

The Mazda CX-80 will be coming to market sometime in 2024 in a bid to provide a more affordable SUV option for Mazda enthusiasts.

It’s expected that the CX-80 will look and feel quite similar to its already available sister models in the CX-60 and CX-90 – and should prove strong competition for other reasonably priced SUVs that we’ve already seen from brands like Toyota.

If you’re looking for a reliable SUV in 2024, make sure you consider the new Mazda CX-80.

3. Audi Q4 e-tron – 2024 Electric Vehicle to look out for

Customers looking for an alternative to larger electric vehicles like the Tesla Model Y will be pleasantly surprised by the arrival of the Audi Q4 e-tron in Australia in 2024.

This sleek new SUV has been available in Europe for a couple of years now and boasts a driving range of up to 560km, which is quite impressive for an electric vehicle – and something that will definitely appeal to Australian audiences who enjoy the open road.

Perhaps the new Audi Q4 e-tron will become your new car in 2024.

4. Kia Sportage Hybrid – 2024 Hybrid Vehicle to look out for

Hybrid vehicles are gaining more and more traction with each passing year here in Australia, and Kia will be looking to capitalise on that when they release the new hybrid version of their popular Sportage model early in 2024.

Boasting many of the same features as the petrol and diesel variants already available here, the Kia Sportage Hybrid will offer a more eco-friendly alternative to their mid-sized line-up without compromising on the key details many Australians already love about the car.

This is definitely one hybrid to keep in mind if you’re looking to buy a new car in 2024.

5. Mitsubishi Triton – 2024 Ute to look out for

If you’re looking for all the grunt you can get from your new car in 2024, then it’s going to be hard to go past the new Mitsubishi Triton ute.

The next generation of Triton has been heavily redesigned in just about every way, with a fresh new body, a powerful new engine and a completely revamped 4WD system and features to make this the ideal choice for ute enthusiasts around the country.

Whether you’re towing the boat, pulling the caravan, or looking to head off-road for a bit of fun on the weekend, the new Mitsubishi Triton will have you covered.

Find the right new vehicle in 2024 at the right price with Private Fleet

Private Fleet empowers you to gain all the benefits of a fleet purchase but as a private buyer.

Backed by decades of vehicle industry experience, fleet buying power and a network of car dealers across Australia, we are here to ensure that buying your next vehicle in 2024 will be as straightforward as possible for you.

Shopping for a car is an enjoyable process – let us make it hassle-free, too.

Reach out to us today for a seamless and simple car-buying experience.

5 Questions You Need To Ask When Financing a Car

So, you’ve decided it’s time to purchase a new car and you’re thinking about taking out a loan – congratulations!

Embarking on the journey of car ownership is an exciting prospect, and car loans are a great way to turn that dream into reality as they enable you to secure a vehicle today, while managing your budget effectively over the long term.

However, to truly unlock the full spectrum of rewards that the right car loan can offer, it’s important to navigate the complexities of car financing wisely.

The most important rule to remember is that when it comes to car financing your car, there is no such thing as a bad question.

In fact, the key to making informed car loan decisions lies in asking several simple yet important questions.

To guide you, we’ve put together a list of the 5 crucial questions you must ask when beginning your car financing journey. By following this guide you’ll be able to drive away confident that you secured the best possible deal.

1. “What are my fees on my loan?”

Most people understand the initial value of their loan, but did you know that your finance arrangement may come with other hidden fees and charges?

Considering these fees aren’t included in the principal or the interest of the initial loan, they can significantly impact the affordability of your finance arrangement. As such, it’s crucial to ask your financial provider if any fees exist and try to minimise them where possible.

Whether it’s origination fees, service charges, or other miscellaneous costs, a comprehensive understanding of these additional costs empowers you to make informed decisions and prevent unexpected financial burdens.

2. “What does it cost to get out of my loan early?”

A car loan may be a fantastic idea today, but unfortunately, it’s impossible to know what the future holds.

To ensure you are not caught off guard in the case of unforeseen circumstances, it’s a good idea to ask your financial provider how much it may cost you to terminate a loan early or even how paying out the loan early may impact the terms of the agreement.

This question, although simple offers flexibility and opens many doors to potential exit strategies.

3. “What Are My Monthly Payments?”

Determining your monthly payment obligations is the most important step toward accurate financial planning and budgeting when purchasing a car through finance.

With so much financial jargon surrounding your car loan, it is best to get a transparent understanding of what is expected from you each month. To do this, ask in no uncertain terms “What are my monthly payments?” and more importantly “How will they change in the future?”

Knowing the exact figure you’ll be allocating each month to repay your loan now and in the future is key to a smoother financial journey allowing you to truly enjoy that new car smell with peace of mind and clarity about what’s expected.

4. “Is My Interest Rate Fixed or Variable?”

That’s right. It isn’t only important to decide between a loan and other payment alternatives, but it’s also vital to consider the types of car loans you have available to you. Asking whether your rate is fixed or variable in nature will help you secure stability or flexibility, depending on what you would prefer from your car loan.

On one hand, a fixed interest rate provides a steady course of action moving forward, offering predictable monthly commitments.

By contrast, a variable interest rate opens the door to rate adjustments and allows you to respond to market fluctuations.

In the end, asking this question is about ensuring that your loan resonates with both your temperament and financial objectives.

5. “What Happens in Case of Late Payments?”

Of course, everybody intends to repay their loan according to the terms of the agreement, but sometimes, life gets in the way so it’s important to understand the consequences of failing to make a payment.

While the chances that you will ever need to make a late payment are unlikely, it is still ideal to take a proactive approach so that you aren’t caught off guard and so you can navigate your financial obligations with foresight and clarity.

Now you know the questions to ask when financing a car!

These are some of the most important questions to ask during the car financing process to ensure you avoid common mistakes and get the best possible deal.

However, this is general information only. The right finance option for you must take into account your unique circumstances and your goals for your car purchase – so always check with your trusted financial professional.

If you find that you still have some questions of your own about car financing, our team at Private Fleet will be happy to answer your concerns and help you find the best deals for your car purchase.

Simply reach out to us and we can have a chat about your options.

Find the right (and affordable) vehicle for you with Private Fleet.

Private Fleet empowers you to gain all the benefits of a fleet purchase but as a private buyer.

Backed by decades of vehicle industry experience, fleet buying power and a network of car dealers across Australia, we are here to ensure that buying your next vehicle will be as straightforward as possible for you.

Shopping for a car is an enjoyable process – let us make it hassle-free, too.

Reach out to us today for a seamless and simple car-buying experience.

Top 5 Considerations When Looking For A New Car in Australia

Are you looking for a new car?

Perhaps your trusty old car has finally given up or you’re just due for an upgrade. Whatever the reason, you need a car that suits your needs.

But there are so many options! Where do you start?

Whether that’s daily errands, trips to the office or even a fun adventure, buying a new car is a significant investment, and it’s essential to make an informed decision to get the best value for your hard-earned money.

In this article, we’ll guide you through the top 5 considerations when looking for a new car, so you can enjoy a hassle-free car-buying experience.

What to look for when buying a new car

Buying a new car is a significant financial decision that requires careful consideration. To save money and get the best value for your investment, it’s important to take your time to research, test drive and negotiate a variety of options.

If you’re not sure where to start, here are the 5 things that you need to take into consideration when looking for a car that will suit your unique needs:

- budget

- vehicle type

- safety features

- fuel efficiency

- maintenance and repairs

Now, let’s discuss these in more detail.

Top 5 considerations when looking for a new car

1. First things first, your budget.

Of course, when buying a new car it’s essential to set a realistic budget that won’t break the bank. To do this, consider both the upfront cost and any ongoing expenses, including insurance, maintenance and fuel.

When you’re looking at your budget, remember to factor in additional costs like registration fees, taxes and any optional extras or accessories you might want to add to your new car. These considerations can also help you decide whether it’s best to take a lease or a loan for your car.

2. Think of the vehicle type.

The type of vehicle you choose depends on your specific needs and preferences. Think about how you’ll primarily use your car. Are you looking for a small and efficient city car for daily commuting or do you need a larger vehicle for family trips and outdoor adventures?

Some of the choices are:

- Sedan: known for their comfortable interiors and smooth rides. These are great for individuals and small families, as they offer ample trunk space and reasonable fuel efficiency.

- SUV (Sport Utility Vehicle): If you need more space for passengers and cargo, an SUV might be the right choice. SUVs are versatile and can handle various road conditions. They’re a popular choice for families and those who need a little extra room.

- Electric or Hybrid: If you’re eco-conscious and want to save on fuel costs, you might consider an electric vehicle (EV) or hybrid vehicle. Australia’s charging infrastructure is growing rapidly which means these cars are becoming more accessible.

These vehicles may offer government-backed incentives too. Read our Quick Guide to Australian EV Incentives here.

3. Check the safety features.

Safety should be a top priority when considering a new car. Australia has stringent safety standards, and it’s important to look for vehicles that meet these requirements. Pay attention to the following safety features:

- Airbags

- Antilock Braking System (ABS)

- Electronic Stability Control (ESC)

- Collision Avoidance Systems

- Child Safety Features

You can also check the ANCAP (Australasian New Car Assessment Program) safety rating for the car you’re interested in.

4. Consider fuel efficiency.

It’s essential to consider a car’s fuel efficiency to save money in the long run. The fuel efficiency of a vehicle is often measured in terms of “litres per 100 kilometres” (L/100km). The lower the L/100km figure, the more fuel-efficient the vehicle is.

If you’re mainly driving in the city, a smaller car with a more fuel-efficient engine is a wise choice. On the other hand, if you frequently undertake long highway journeys or have a larger family, a fuel-efficient SUV might be a better fit.

5. Ask about long-term maintenance and repairs.

Consider the long-term costs associated with maintaining and repairing your new car.

To do this, research common maintenance needs for the make and model you’re interested in. Some cars may have more expensive parts or require specialised servicing, so to save money in the long run, it’s a good idea to choose a vehicle with readily available and affordable replacement parts.

Make informed decisions when buying a car

By keeping these top 5 factors in mind, you can make an informed choice that not only meets your needs but also saves you money in the long term. Also, don’t be afraid to take your time, do your research and test-drive several models to find the perfect new car for your lifestyle.

Our team of car-buying professionals are also here to help you.

Find the right vehicle at the right price with Private Fleet

Private Fleet empowers you to gain all the benefits of a fleet purchase but as a private buyer.

Backed by decades of vehicle industry experience, fleet buying power and a network of car dealers across Australia, we are here to ensure that buying your next vehicle will be as straightforward as possible for you.

Shopping for a car is an enjoyable process – let us make it hassle-free, too.

Reach out to us today for a seamless and simple car-buying experience.

Should I Repair My Car or Buy a New Car?

Sometimes it’s hard to let go and move onto a new vehicle.

Whether it’s an emotional attachment to our pride and joy, or the belief that a new car is less attainable and will end up costing us more – we often like to give ourselves a reason to resist change.

But while these may be factors we care to consider, the more pertinent questions we should be looking into are how the numbers stack up, and what our personal circumstances are.

The easiest way to consider this is to separately assess the here and now, from the future. When it comes to the here and now, you need to consider the up–front costs associated with purchasing a new vehicle. This obviously includes tangible elements, but also intangible factors too.

Weighing up a new car

Starting with the obvious, to fund your purchase it is likely you will either need to trade in your existing vehicle, supplement it with savings or finance, or take out a loan for the entirety of the car’s price. And when interest rates are rising, that’s an even bigger consideration.

This introduces potential cash flow strains, as to get the best possible financial outcome, it’s better to pay off as much of the initial purchase cost as possible. The downside means you will be left with less disposable expenditure if you make a larger up–front payment.

Looking at a lengthier timespan, you’re facing interest repayments, maintenance, repairs, registration and insurance costs. Besides that, there are operational costs concerning fuel efficiency.

To help form a comparison, you’ll want to break these expenses into weekly, monthly and annual prices for the ownership of your vehicle.

Choosing to repair your current car

On the other side of the ledger, you’re operating a car that does not involve an initial cost. But while there may not be up–front costs involved, ongoing operational expenses are likely to cost significantly more than a new vehicle.

You have to keep in mind that an existing or used car, particularly an old one, is usually more prone to repairs or maintenance even if in good condition.

And when such maintenance or repairs are undertaken, parts may be far dearer considering their scarcity, or you may need to replace more parts considering their life span could be surpassed.

An existing car is also more likely to be less fuel efficient than newer models. There is a greater chance you will pay more to fuel your current car. If you have repayments due, you should also assess these so that you’re including all relevant costs.

One thing that does generally work in favour of existing cars is that insurance is likely to be cheaper, although this is just a rule of thumb as opposed to a certainty.

New cars are also stung by a huge depreciation expense which, depending on your circumstances, could be beneficial as a business owner using the car for taxable business purposes.

What else to consider?

Keep in mind a couple other things.

With old vehicles more likely to break down, what impact will this have on other aspects of your life? How will you get around while you don’t have access to a vehicle? Could it impede family matters such as taking the kids to school, or dropping a spouse off at work?

There may also be features that are less safe compared with today’s cars because of technological advancements.

In deciding, you may wish to adopt a particular line of thought – if the repairs or operating expenditure for an existing vehicle surpass the car’s market value, or the financing of a new vehicle, or even the repayments due on the current vehicle over the course of a year, move on and purchase a new car.

If on the other hand things are still running well, and relatively affordable, or you’re in a position where you can’t afford to outlay a large initial capital cost, keep on top of maintenance to defer the decision.